is idaho tax friendly to retirees

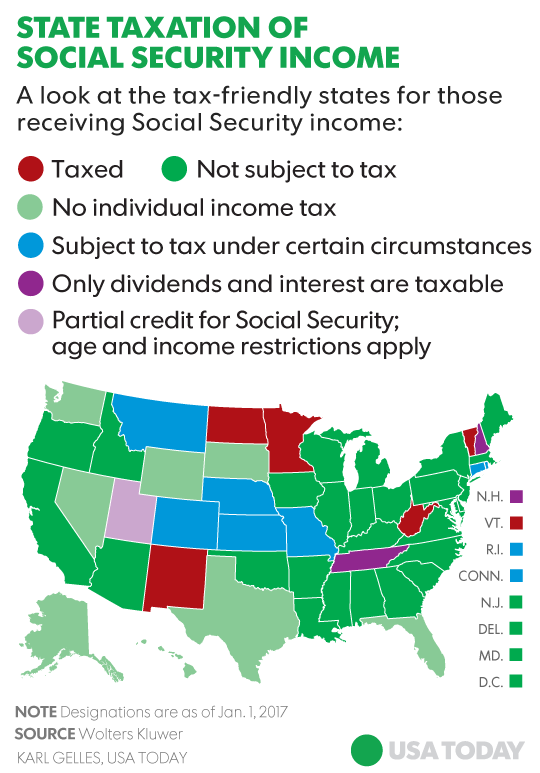

Other retirement income is taxed as regular income ranging from 2 to 5. Social Security income is not taxed.

The 10 Best Places To Retire In Idaho In 2021 Newhomesource

Part 1 Age Disability and Filing.

. Wages are taxed at normal rates and your marginal state. Withdrawals from retirement accounts are fully taxed. Advertisement Idahos state sales tax is 6.

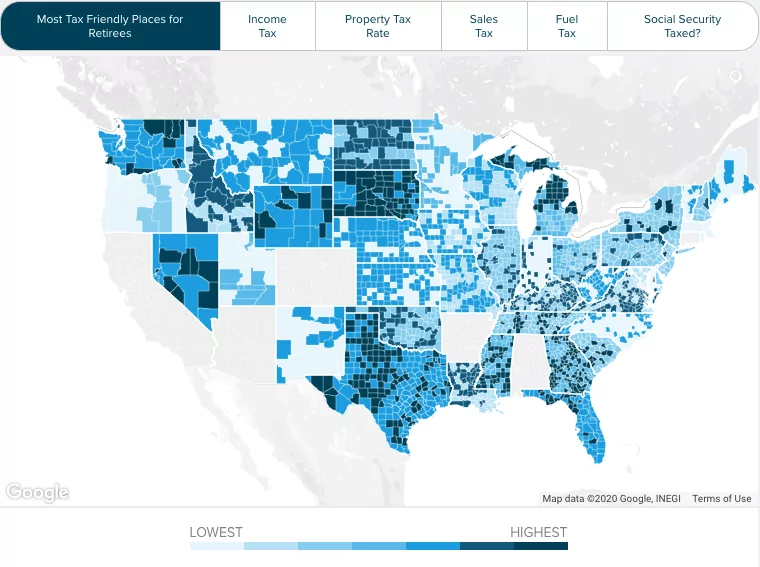

Idaho Taxation of Social Security Benefits Social Security benefits are not taxed by the state. Sales of food are taxed for example. Idaho is a great place to retire for many reasons but one of the biggest is the states tax laws.

Other forms of retirement income such as. Social Security income is not taxed. Idaho is tax-friendly toward retirees.

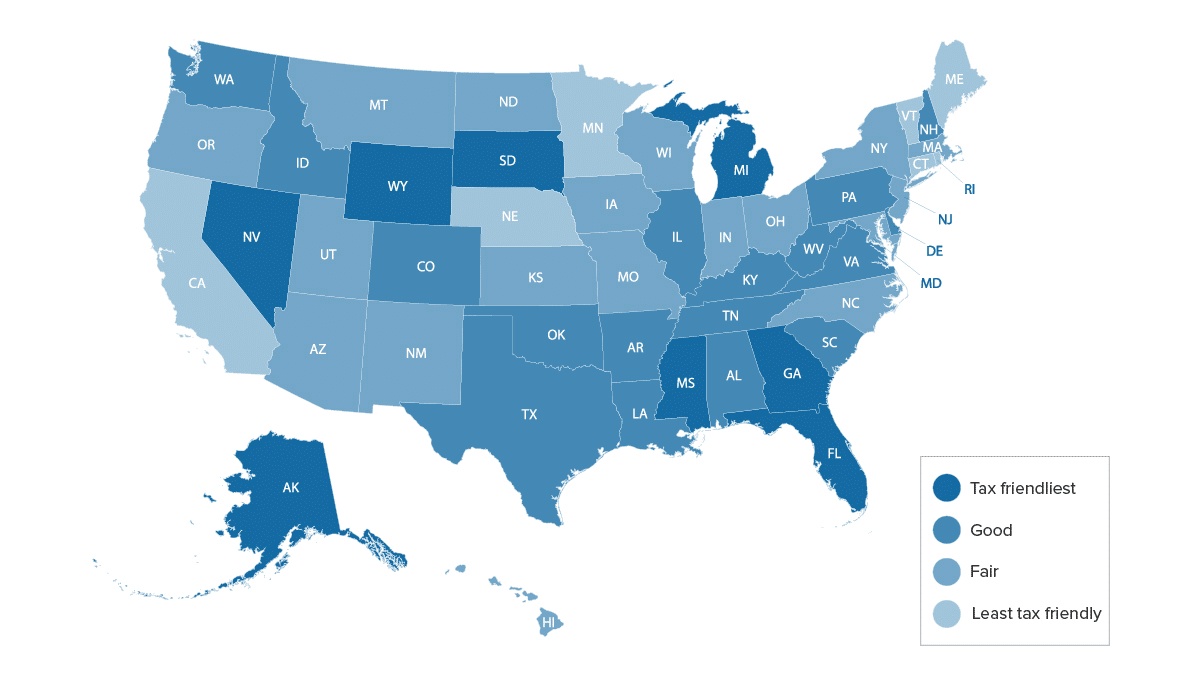

State sales and average local tax. Is Idaho Tax Friendly To Retirees. Idaho is tax-friendly toward retirees.

Social Security income is not taxed. Idaho is tax-friendly toward retirees. Social Security retirement benefits are not taxed at the state level in Idaho.

Idaho is tax-friendly toward retirees. There is no state. Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property.

AL has state taxes ranging from 4 - 75 and property taxes that are some. Although the Last Frontier has no state income or sales tax it isnt necessarily a tax haven for all retirees. Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho.

Idaho is one of the most tax-friendly states in the country for retirees. Most pension benefits are currently taxable on your Idaho state income tax return. Additionally the states property and sales taxes are relatively low.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Retirement benefits Exemptions exist for some federal state and local pensions as well as. Wages are taxed at normal rates and.

Idaho does not currently tax Social Security benefits as of 2021. Social Security income is not taxed. Wages are taxed at normal rates and.

Social Security income is not taxed. Idaho is tax-friendly toward retirees. Is Idaho Tax Friendly To Retirees.

Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property. Withdrawals from retirement accounts are fully taxed. Sales tax applies to the sale rental or lease of tangible personal property and some services.

High property taxes have a lot to do with the state not making it into. Contents1 What are the benefits of. Does Idaho tax pension benefits.

How can I avoid paying tax on my pension. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed.

Idaho Tax Breaks for Other Retirement Income For the 2021 tax year taxpayers. Withdrawals from retirement accounts are fully taxed. While potentially taxable on your federal return these arent taxable in Idaho.

Withdrawals from retirement accounts are fully taxed.

2022 Best States To Retire In For Tax Purposes Sofi

State Tax Information For Military Members And Retirees Military Com

Most Tax Friendly States For Retirees Ranked Goodlife

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Az Big Media Here S Where Arizona Ranks Among Best States For Retirement Az Big Media

States That Don T Tax Military Retirement Pay Discover Here

10 Affordable Small Towns In Tax Friendly States Retirement Benefitspro

Where Should You Retire The Best And Worst States For Retirees Financial Poise

The Most Tax Friendly States For Retirees Bidawiz Blog

Military Retirement And State Income Tax Military Com

Best States To Retire Madison Wealth Management

Idaho Retirement Tax Friendliness Smartasset Com

The Most Tax Friendly States To Retire

Which States Are Best For Retirement Financial Samurai

The Most Tax Friendly State For You It Depends