michigan property tax rates by township

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331401 511401 271401 391401 331401 511401 BLOOMINGDALE PUBLIC S 315733 495643 255733 375643 315733 495643 Clyde Twp 031040 FENNVILLE PUBLIC SCHO 293224 473224 233224 353224 293224 473224. 2018 Millage Rates - A Complete List.

Property Taxes Hartland Township Michigan

The list is sorted by median property tax in dollars by default.

. Pittsfield Township has the 3 rd highest population and is one of only two municipalities to be a full-service community while maintaining the 6 th lowest tax rate in Washtenaw County. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with. 84 rows Minnesota.

Penalty and interest per month is applied to the delinquent tax when paid at the county. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce CountyFor more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below.

Georgetown Charter Township Office 1515 Baldwin Street PO. On February 14 2023. Brownstown Township continually collects delinquent taxes for Personal Property TAX ONLY businesses only.

2017 Millage Rates - A Complete List. 33215 Waverly of Total. A listing of the 100 cities and townships with the largest property tax bases in Michigan.

Beginning March 1st all real estate property tax must be paid to the Van Buren County Treasurers office. Washtenaw County collects the highest property tax in Michigan levying an average of 391300 181 of median home value yearly in property taxes while Luce County has the lowest property tax in the state collecting an average tax of 73900 086 of. Individual Exemptions and Deferments.

2020 Millage Rates - A Complete List. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. Please contact the Van Buren County Treasurer at 269-657-8228 or 219 E.

Collect and perform jeopardy assessments on personal property taxes. For new homeowners please contact the. Winter Tax Bills - Are mailed out by December 1 and are payable at the Township offices without penalty until 430 pm.

Estimate Your Property Taxes Millage Rate Information. Michigan Department of Treasury Property Tax Web Portal. Median property tax is 214500.

33020 Lansing of Total. This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of median income. Box 769 Jenison MI 49429-0769 Phone.

The school district your property is located in determines the annual millage rates applied to calculate the taxes on your property. 2021-2022 Statutory Tax Collection Distribution Calendar. Real and personal property taxes are the combined total of school taxes local intermediate community college and state education library county taxes operating and 911 county transit and township taxes.

Paw Paw Street Paw Paw MI 49079 for more information or payoff amounts on. Maintain accurate records of all income receipts and disbursements. For existing homeowners please enter the current taxable value of your property.

You can use the Michigan property tax map to the left to compare Emmet Countys property tax to other counties in Michigan. 50 East VW Avenue Vicksburg MI 49097. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 319946 499946 259946 379946 359946 539946 FENNVILLE PUBLIC SCHO 288656 465848 228656 345848 328656 505848 BLOOMINGDALE PUBLIC S 313285 489191 253285 369191 353285 529191 Leighton Twp 031130.

2019 Millage Rates - A Complete List. You can sort by any column available by clicking the arrows in the header row. 616-457-3670 Contactgeorgetown-migov Office Hours - Mon thru Fri.

2005 Public Act 24 of 2005 has amended Section 51 of the Michigan General Property Tax Act MCL 21151 to allow the following residents. Michigan property tax rates by township Monday March 14 2022 Edit. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP.

The City of Ann Arbor Pittsfield Charter Township are the ONLY full service municipalities in Washtenaw County providing direct police fire water sewer parks and recreation services to the community. Then the local unit must impose a property tax administration fee at a rate equal to the rate of the fee imposed for city or township taxes on that parcel unless there. Northville Township can accept payment until 430 pm.

33070 Holt of Total. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way. See for example Graham v City of Saginaw 317 Mich 427.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Holland City 032030 HAMILTON COMMUNITY S 372777 552777 312777 432777 372777 552777 HOLLAND CITY SCHOOL D 411934 591934. 2022 Property Tax Calendar. Property tax information is available on the Oakland County 24 Hour Tax Hotline by dialing 248-858-0025 or toll.

Ada Township had a total taxable value of 986136828 in 2018 of which 81 is residential property. Michigan case law has long drawn a distinction between ad valorem taxes and traditional special assessments. Invest Township funds in approved investment vehicles.

Beginning March 1 2022 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North Telegraph Pontiac Michigan 48341 with additional penalties. Senior Citizens age 62 and older Paraplegic or Quadriplegic. BURT TOWNSHIP SCHOOL 278642 458642 218642 338642 278642 458642 Grand Island Twp 021030.

Michigan General Property Tax Act. Personal Property Tax Bills. This can be obtained from your assessment notice or by accessing your tax and assessing records on our Property Tax Search website.

All Remaining Tax Balances - will have 3 penalty added after 430 pm.

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Winter Tax Bill Example Macomb Mi

Tax Bill Information Macomb Mi

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold It And Kept The Profits Reason Com Property Tax County Tax

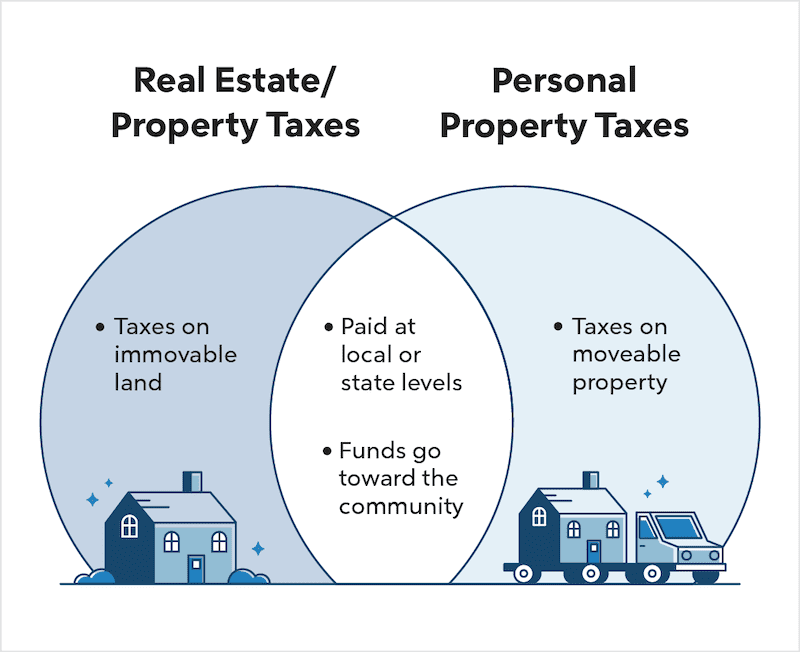

Real Estate Taxes Vs Property Taxes Quicken Loans

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney

What Do Your Property Taxes Pay For

Property Tax By County Property Tax Calculator Rethority

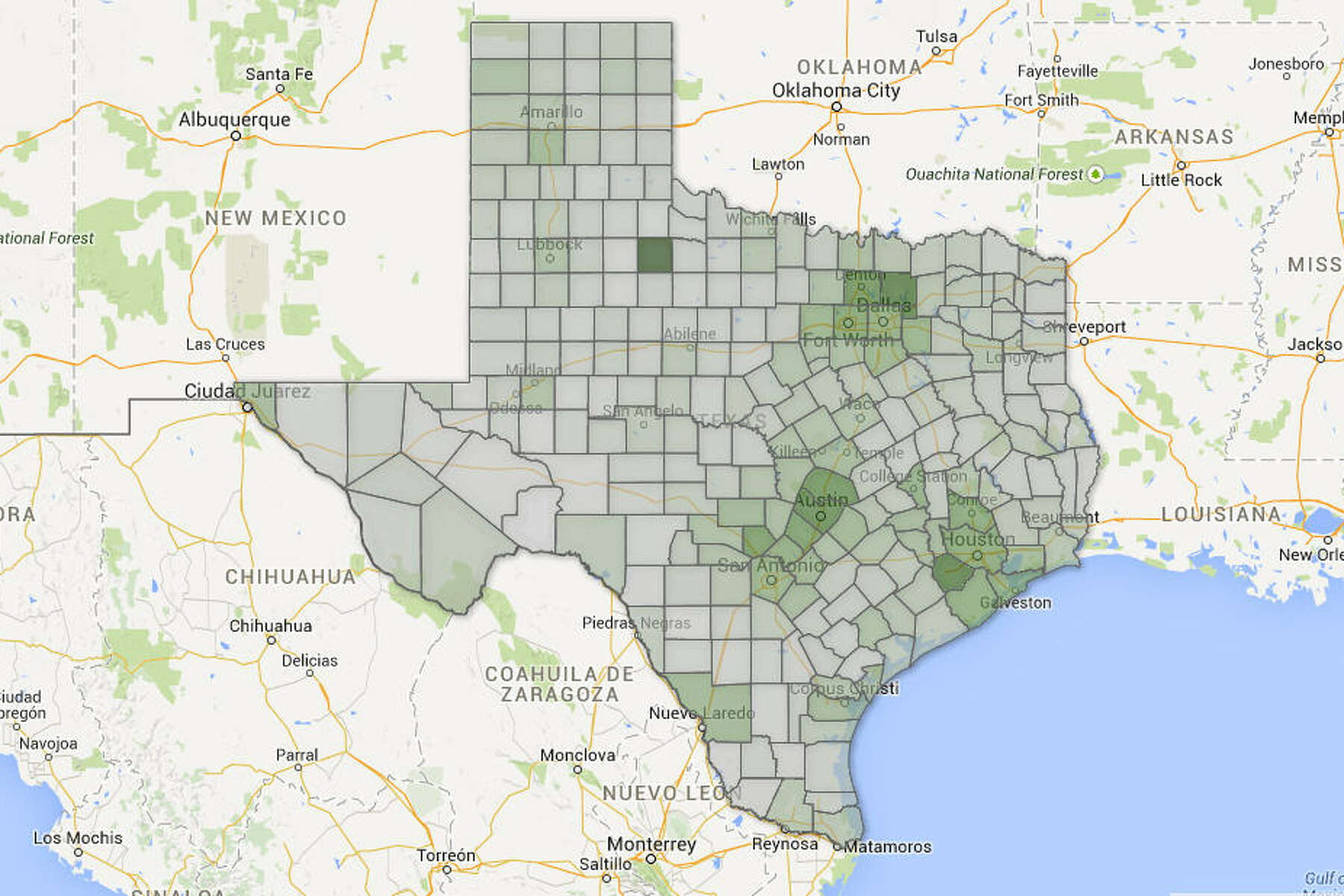

Texas Property Taxes Among The Nation S Highest

Michigan Property Tax H R Block

King County Wa Property Tax Calculator Smartasset

How To Calculate Michigan Property Taxes On Your Investment Properties

Real Estate Taxes Vs Property Taxes Quicken Loans

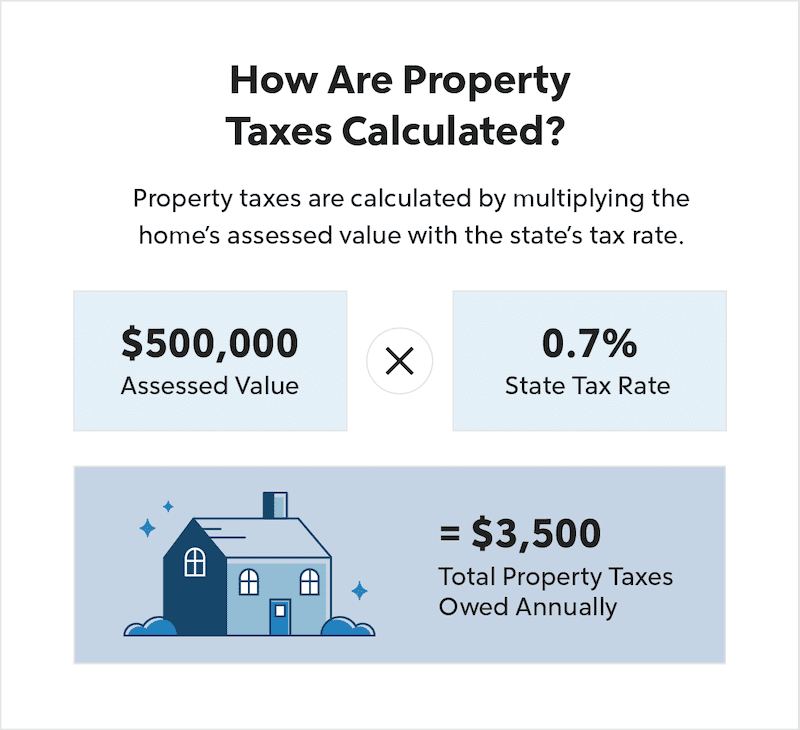

Property Tax How To Calculate Local Considerations